WTF: Atlassian Acquires The Browser Co?!?

So many takes on this acquisition so let's break it down constructively...

Hi there, it’s Adam. I started this newsletter to provide a no-bullshit, guided approach to solving some of the hardest problems for people and companies. That includes Growth, Product, and company building. Subscribe and never miss an issue. If you’re a parent or parenting-curious I’ve got a Webby Award Honoree podcast on fatherhood and startups - check out Startup Dad.

Questions you’d like to see me answer? Ask them here.

Many takes on Atlassian acquiring The Browser Company so I thought I'd actually break this down strategically to see if any of it makes sense.

First, The Browser Company makes (made?) Arc (a chromium based browser), attempted a search-first AI application for your phone, and has recently invested a lot in Dia which is a next generation AI-first browser.

They've raised ~$130M and were last valued at $550M until Atlassian announced they were acquiring them this week for $610M. So a ~4.7x markup on the invested capital in ~6 years.

Most of the questions and takes I've heard about this acquisition go something like this:

Why did Atlassian pay $610M for a browser company that doesn't make money?

Why can't I get acquired for $610M if I just make highly-produced marketing videos?

Why couldn't TBC make it on their own?

Atlassian is going to JIRA-ify this product SO fast. They're doomed.

Numerous memes, dunks, etc. The internet had a GREAT time with this one.

Okay, so let's start with the assumption that Atlassian has a ton of smart people working in their CorpDev department -- they have made other, quite great acquisitions and so I'm sure there was a thesis here.

The Browser Company couldn't make it on its own because they had no, meaningful revenue model for their browser and had painted themselves into a corner. Today, the only revenue model for browsers is paid search deals and advertising. With the DOJ ruling from this week saying Google can still pay for default search placement that doesn't seem to be changing anytime soon.

In order to have a meaningful "Google pays us" model you have to have usage to send Google a lot of traffic (since most of their deals are a revshare on search result ad clicks). Getting to levels of usage that are interesting to Google for *a new* entrant in the very crowded browser category is *very* challenging. Safari, which is used by a zillion mobile deviceholders only has about 15% of the marketshare of the browser market. Google has 65-70% with Chrome. And # 3 is in the single-digit percentages.

Furthering this challenge is that Arc integrated (or tried to) a bunch of AI stuff into the browser that would cause people to not use Google Search anymore. For example, in my Arc instance I've had Perplexity as the default search since I installed Arc a few years ago. Dia is even *more* in this direction since it is quite literally an AI browser. These products cater to the tech early adopters and not much else and Arc didn't have a strong value prop and counter-positioning to Chrome so... why switch? So no traffic, no revenue, no hopes of getting there really (even with Dia).

They couldn't do subscriptions because that's not going to generate enough $ to give a return to VCs of any kind (or probably even cover their costs) and people don't want to pay for a commodity product (web browser) that they generally can't even remember the name of. So TBC couldn't keep going on its own and it couldn't raise more capital after grabbing $130M.

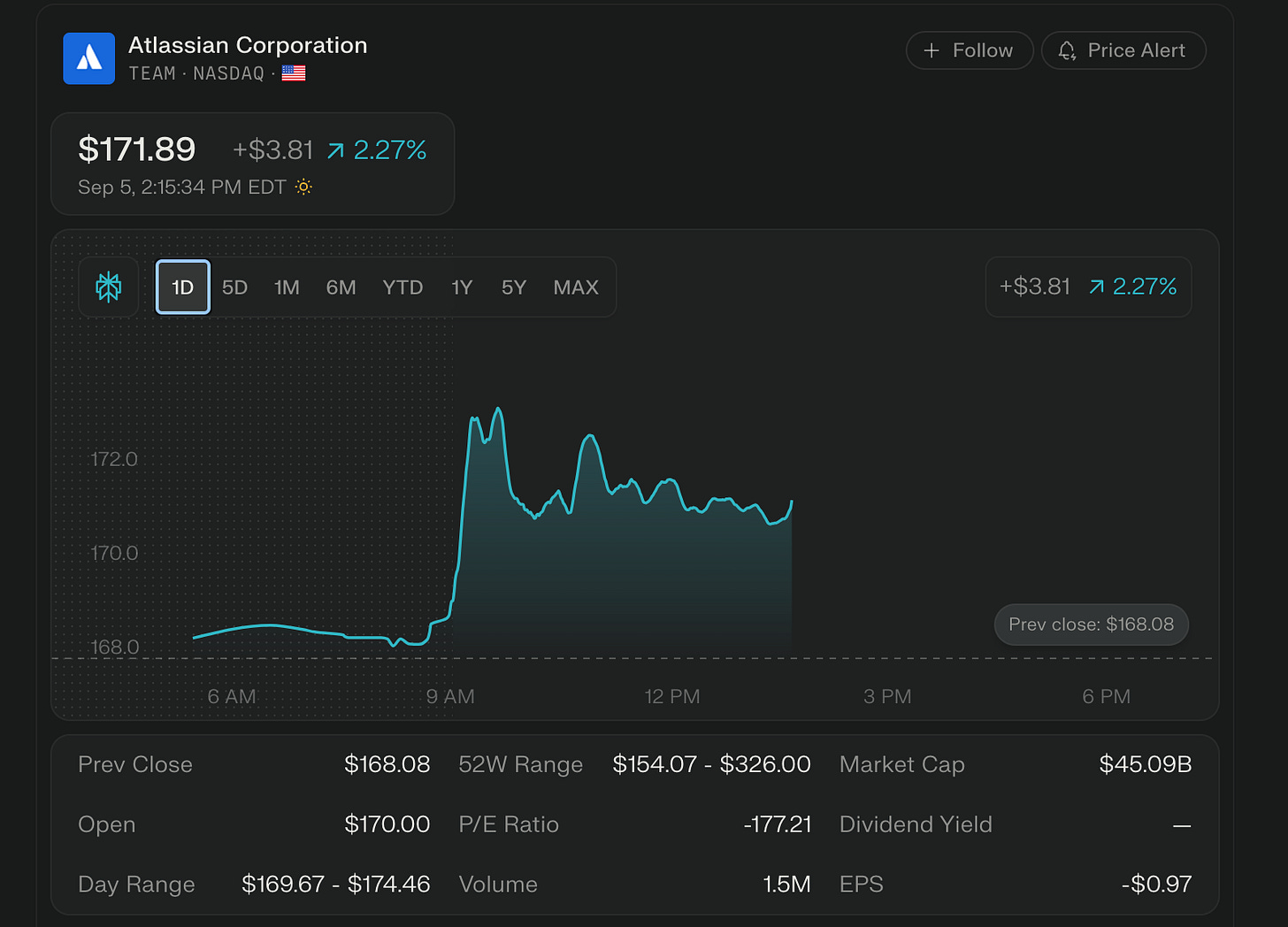

Enter Atlassian. They stroll in like the ~$44 - 45B market cap company they are… with the product that everyone (everyone) hates but can’t seem to overcome their Stockholm Syndrome enough to switch to Linear (kinda like Salesforce) and drops $610M in cash on TBC.

So, WHY?

If you read their announcement they’re now working on the AI browser for knowledge workers. When I was working with Mozilla one of my theories was that the Enterprise browser was the only new entrant that you could create (see Island for reference) because Enterprises will pay for stuff that makes their workers less distracted, more secure, and ideally more productive.

And that has been Atlassian’s whole thing with an integrated suite of stuff that helps up and down the stack. Yes, it’s mediocre software that is poorly designed and has terrible UX, but it also has lock-in. And expansion. And a go to market engine that is already primed to cram a new product down customer’s throats. And Atlassian is much more acquisitive than they are good at really building products on a new horizon. Not to mention they have been pretty lackluster in the “sprinkle some AI on it” department. And the team at TBC has a few things that Atlassian lacks:

A browser that they’ve been working on for awhile.

AI expertise.

Browser-building expertise.

Visibility into the sites visited by their users.

Design chops.

Video-making chops.

Founder energy.

A head start.

So they saw an opportunity to spend ~20% of their cash-on-hand and get a team with the 8 things above. Now, 20% is a lot, but Atlassian has good free cashflow so they’ll recoup that pretty quickly. They also have a way to signal to the market that they’re serious about innovating, they get the AI thing, and they understand that they’re only as good as the platform they sit on top of (the browser).

The market kind of likes it?

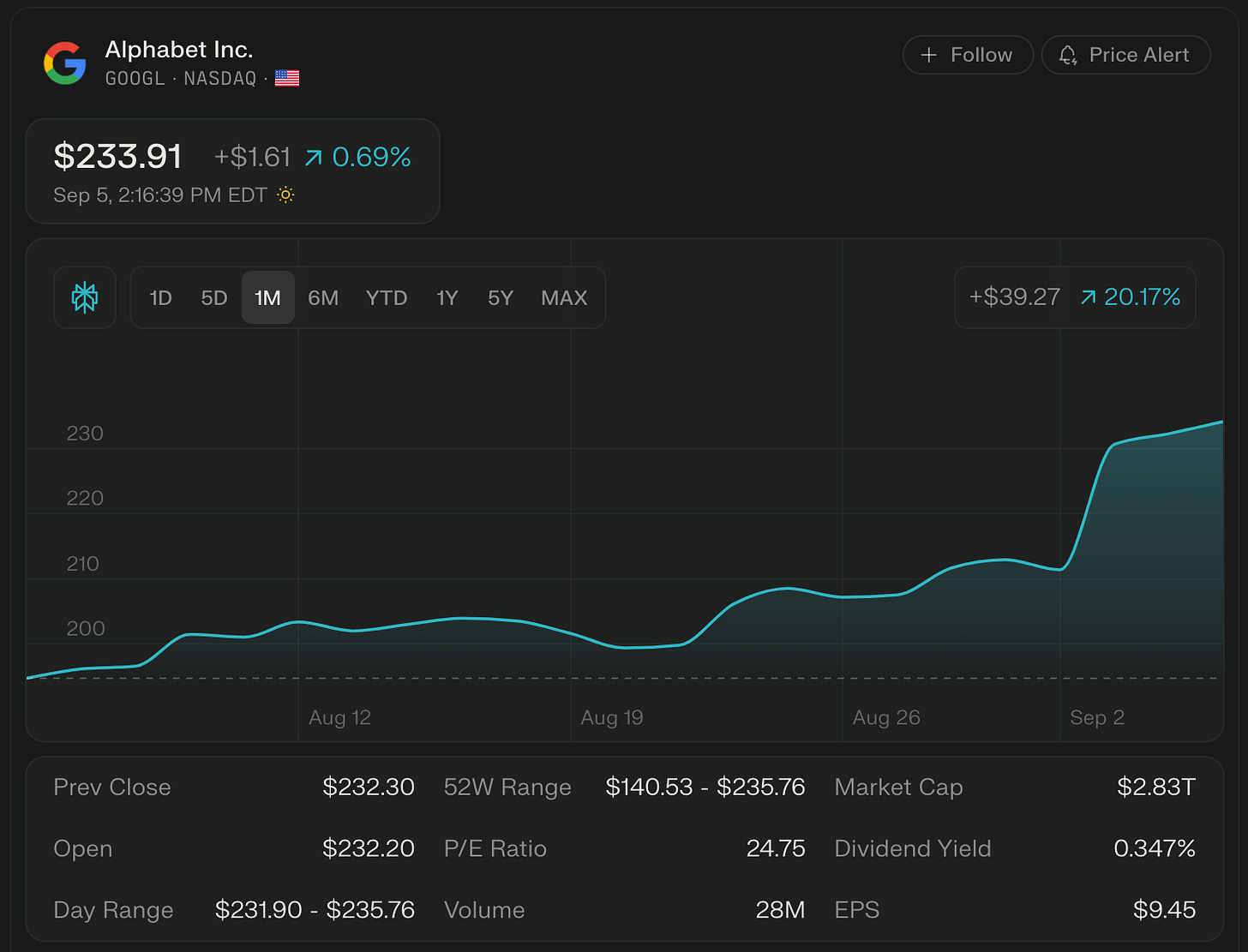

Though not as much as Google getting very favorable results in their DOJ case…

So, given all of this it might make some sense why Atlassian would do it and the market agrees a little bit. At the very least, let’s see a company that hasn’t taken a risk since I was in college try to give themselves a shot in the arm with an acquisition. Or two (they also acquired Cycle this week, for an undisclosed sum).

So yes, will they JIRA-ify the beautiful design of Dia? Probably a little bit. Are they hoping that some of that founder mode energy rubs off on the rest of the company? Absolutely. And will this actually be a successful acquisition for them… I guess time will tell but I think it could help them a decent amount. Whether it’s worth 20% of their cash… probably not, but maybe that’s what it took to get this team and their expertise.

Curious to hear other people’s takes below in the comments. Let ‘er rip.

Until next time,

Adam

I think they were just afraid that Notion was going to buy TBC

I feel like there's almost no way this changes Atlassian's energy or almost anything meaningful.